|  | | China Macro Reporter | | By Malcolm Riddell·September 3, 2020 | | Opening Statement |

|

Greetings!‘None of the disputes between the U.S. and China, even the South China Sea, has as much explosive potential as contemplated changes in America's relations with Taiwan,’ writes Jerry Cohen. - Among those contemplated changes is abandoning the decades-old U.S. policy of not confirming that it would defend Taiwan against an unprovoked attack by China – the policy of ‘strategic ambiguity.’

- In other words, saying directly: ‘Xi Jinping, if you attack Taiwan, we will defend the island, and you will be at war with the U.S.’

You would not be faulted for thinking this was coming from the China Hawks in the Trump administration. - In fact, the loudest voices calling for this policy change are coming from the mainstream foreign policy community.

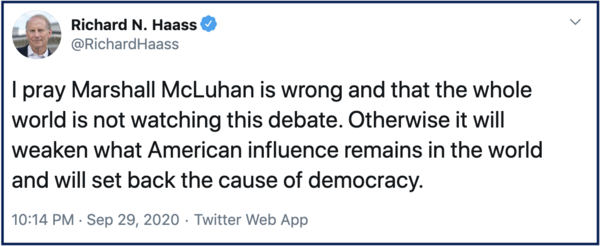

Just this week, Jerry Cohen, dean of China legal scholarship in the U.S., and Richard Haass, president of the Council on Foreign Relations, have both called for the U.S.’s abandoning ‘strategic ambiguity.’ [Today’s issue is bookended by their essays.] - Jerry Cohen writes: ‘Most important, the United States should abandon the policy of "strategic ambiguity" that fosters uncertainty about whether it will come to the defense of Taiwan, since this ambiguity increases the risk that conflict might result from mistaken assumptions on Beijing's part.’

- And Richard Haass argues: ‘Indeed, such a change should strengthen U.S.-Chinese relations in the long term by improving deterrence and reducing the chances of war in the Taiwan Strait, the likeliest site for a clash between the United States and China.’

This assumes, of course, that Xi Jinping himself sees this as a deterrent. - And not a signal to attack Taiwan immediately, catching the U.S. flatfooted before it could act on its new commitment.

It is one thing to help Taiwan repel a Chinese attack. - It is another to recapture Taiwan from Chinese occupation.

And, based on U.S. wargames, there is a real question about whether the U.S. could prevail in either case. - Add to that the uncertainty about President’s Trump acting on U.S. commitments to its allies, and Xi could decide act if the policy changes.

In the West, we tell ourselves that Xi Jinping would never damage China’s economy and political standing just to reunite Taiwan with China. Since the KMT retreat to Taiwan in 1949 in the wake of a communist victory, the Chinese Communist Party has had no higher objective. - Unlike his more patient predecessors, Xi Jinping sees the window for achieving this closing.

- Nothing closes that window faster than the S. abandoning ‘strategic ambiguity’

All that said, I agree (and have argued here) that the U.S. should abandon ‘strategic ambiguity.’ - My concern is that we might do this, as the U.S. has done disasterously throughout its history, without taking the other guy’s point of view into consideration.

In this issue: 1. 'Taiwan Needs Unambiguous American Support' - A surprising (to me) statement by a leader of the foreign policy establishment on a long-needed policy change.

2. 'TikTok Deal Is Complicated by New Rules From China Over Tech Exports' ‘In a bureaucratic two-step, China on Friday updated its export control rules to cover a variety of technologies it deemed sensitive, including technology that sounded much like TikTok’s personalized recommendation engine.’ Scott Kennedy of CSIS says: - “At a minimum they’re flexing their muscles and saying, ‘We get a say in this and we’re not going to be bystanders.”

- “It could be an effort to outright block the sale, or just raise the price, or attach conditions to it to give China leverage down the road.”

- ‘He added that it showed a rare bit of consensus between China and the United States that both agreed ByteDance was a national security priority.’

In any case, this is one of the rare times when China has pushed back, however indirectly, against a U.S. move against it. 3. 'Huawei: Has Trump Really Won?' ‘The Commerce Department’s actions are likely the death blow against Huawei.’ - Even its most secure markets will switch to new suppliers to prevent the inevitable disruption that will occur when its two-year stockpile of U.S.-made chips dries out.’

‘In the context of the U.S.-China tech war, the dashing of Huawei’s global aspirations is but one battle, and the United States should expect a punitive retaliation against its technology companies by the Chinese government.’ 4. 'The Big China Disaster That You're Missing' The disaster here is flooding in China, and here is an impact that should be factored in analyses: - ‘Consider this knock-on effect.’

- ‘In theory, banks will likely take losses because of natural disasters; their clients will pass them along to insurers.’

- ‘The last thing China’s burdened, state-run financial institutions need are continued natural disasters.’

5. 'Don't Rush to Fully Normalize Relations With Taiwan' Jerry Cohen writes: - ‘Given the anti-PRC atmosphere in Washington, there is even interest in possible establishment of formal diplomatic relations between the United States and Taiwan.’

- ‘Such "recognition" of the island's government, whether under its current name—the Republic of China (Taiwan)—or as a newly-branded Republic of Taiwan, would very likely trigger a long-threatened military reaction from Beijing that could envelop the PRC, the United States and Taiwan in a devastating nuclear war.’

He also provides an excellent briefing on the events in China-Taiwan-U.S. relations that brought us to this point. Go deeper into these issues - Browse the posts below.To read the original article, click the title.Let me know what you think. And please forward the China Macro Reporter to your friends and colleagues. All the best, Malcolm |

| 1. To Avoid War with China, Pledge to Defend Taiwan |

| Foreign AffairsRichard Haass | President, Council on Foreign Relations‘The time has come for the United States to introduce a policy of strategic clarity: one that makes explicit that the United States would respond to any Chinese use of force against Taiwan.’‘For four decades, successive Republican and Democratic administrations resisted answering the question of whether the United States would come to Taiwan’s defense if China mounted an armed attack.’ - ‘Washington’s deliberate ambiguity on the matter helped dissuade China from attempting to “reunify” Taiwan with the mainland, as it could not be sure that the United States would remain on the sidelines.’

- ‘At the same time, the policy discouraged Taiwan from declaring independence—a step that would have precipitated a cross-strait crisis—because its leaders could not be sure of unequivocal U.S. support.’

‘The policy known as strategic ambiguity has, however, run its course.’ - ‘Ambiguity is unlikely to deter an increasingly assertive China with growing military capabilities.’

‘The United States should adopt a position of strategic clarity, making explicit that it would respond to any Chinese use of force against Taiwan.’ - ‘Such a policy would lower the chances of Chinese miscalculation, which is the likeliest catalyst for war in the Taiwan Strait.’

‘If the United States maintains this policy of ambiguity it will not keep the peace in the Taiwan Strait for the next four decades.’ - ‘Too many of the variables that made it a wise course have fundamentally shifted.’

‘China now has the capability to threaten U.S. interests and Taiwan’s future.’ - ‘China’s defense spending is 15 times that of Taiwan’s, and much of it has been devoted to a Taiwan contingency. Chinese planning has focused on impeding the United States from intervening successfully on Taiwan’s behalf.’

‘Gone are the days when Taiwan’s dollars went further than China’s, as China now fields equipment on a par with anything the United States makes available to Taiwan.’ ‘Whether the United States could prevail in a Taiwan conflict is no longer certain, and the trend lines continue to move in China’s favor.’ ‘Unless the United States devotes significant resources to preparing for a conflict in the Taiwan Strait, it stands little chance of preventing a fait accompli.’ - ‘Waiting for China to make a move on Taiwan before deciding whether to intervene is a recipe for disaster.’

‘One thing has not changed over these four decades: an imposed Chinese takeover of Taiwan remains antithetical to U.S. interests.’ - ‘If the United States fails to respond to such a Chinese use of force, regional U.S. allies, such as Japan and South Korea, will conclude that the United States cannot be relied upon and that it is pulling back from the region.’

‘These Asian allies would then either accommodate China, leading to the dissolution of U.S. alliances and the crumbling of the balance of power, or they would seek nuclear weapons in a bid to become strategically self-reliant.’ - ‘Either scenario would greatly increase the chance of war in a region that is central to the world’s economy and home to most of its people.’

‘Meanwhile, the 24 million people of Taiwan would see their democracy and freedoms crushed. China would subsume the island’s vibrant, high-tech economy.’ - ‘And China’s military would no longer be bottled up within the first island chain: its navy would instead have the ability to project Chinese power throughout the western Pacific.’

‘China’s aim to gain control of Taiwan, through force if necessary, needs to be taken seriously.’ - ‘There is speculation that Xi will marry his ambitions with the new means at his disposal to realize his “China Dream” and force “reunification” with Taiwan, potentially as soon as 2021.’

- ‘No one should dismiss the possibility that Taiwan could be the next Hong Kong.’

‘Washington can make this change in a manner that is consistent with its one-China policy and that minimizes the risk to U.S.-Chinese relations.’ - ‘Indeed, such a change should strengthen U.S.-Chinese relations in the long term by improving deterrence and reducing the chances of war in the Taiwan Strait, the likeliest site for a clash between the United States and China.’

|

| 2. The TikTok Issue Just Got More Complicated |

The New York TimesPaul Mozur | The New York Times‘The moves from Beijing ensnare TikTok and potential American buyers including Microsoft and Oracle, wedging them in the middle of a tussle between the United States and China over the future of global technology.’‘As the sale of TikTok enters its final stages, Beijing is saying it wants the last word.’ - ‘In a bureaucratic two-step, China on Friday updated its export control rules to cover a variety of technologies it deemed sensitive, including technology that sounded much like TikTok’s personalized recommendation engine.’

‘Then on Saturday, the country’s official Xinhua news agency published commentary by a professor who said the new rule would mean that the video app’s parent, the Chinese internet giant ByteDance, might need a license to sell its technology to an American suitor.’ - ‘It is exceedingly rare for a professor to make comments about a specific, in-progress deal, and that it signaled that ByteDance would now have to consult the Chinese authorities about the controls said Scott Kennedy of the Center for Strategic and International Studies.’

‘Beijing’s last-minute assertion of authority is an unexpected wrinkle for a deal as two groups race to buy TikTok’s U.S. operations before the Trump administration bans the app.’ - ‘Taken together, the rule change and the commentary in official media signaled China’s intention to dictate terms over a potential deal, though experts said it remained unclear whether the Chinese government would go as far as to sink it.’

‘The moves from Beijing ensnare TikTok and potential American buyers including Microsoft and Oracle, wedging them in the middle of a tussle between the United States and China over the future of global technology.’ - ‘Beijing’s displeasure alone could scare off TikTok’s suitors, many of whom have operations in China.’

- ‘TikTok is the most globally successful app ever produced by a Chinese company, and the conflict over its fate could further fracture the internet and plunge the world’s two largest economies into a deeper standoff.’

‘ “At a minimum they’re flexing their muscles and saying, ‘We get a say in this and we’re not going to be bystanders,” said Scott Kennedy.’ - ‘ “It could be an effort to outright block the sale, or just raise the price, or attach conditions to it to give China leverage down the road,” he said.’

- ‘He added that it showed a rare bit of consensus between China and the United States that both agreed ByteDance was a national security priority.’

‘If Beijing blocks the sale of TikTok, it would effectively be calling the Trump administration’s bluff, forcing the U.S. government to actually go through with restricting the app and potentially incurring the wrath of its legions of influencers and fans.’ - ‘Ordering companies like Apple and Google to take down TikTok in app stores globally could also prompt further anger against the Trump administration and even lawsuits.’

‘Beijing’s move also could risk empowering the more hawkish members of Mr. Trump’s team and igniting an even more forceful response from the administration, which has said that it could take more measures to block tech companies like Alibaba and Baidu from doing business in the United States.’ |

| 3. Huawei: Has Trump Really Won? |

Foreign AffairsConnor Fairman | Council on Foreign Relations‘The Commerce Department’s actions are likely the death blow against Huawei.’‘On August 17, the U.S. Department of Commerce announced that non-U.S. companies were prohibited from selling items produced with U.S. technology to Huawei.’ - ‘The decision follows restrictions imposed by the Commerce Department in May against companies using U.S. technology to manufacture Huawei-designed chips, which left open the possibility for the company to purchase widely available chips designed by other companies.’

- ‘This latest effort has been cited by some as the “nail in the coffin” for the company, as U.S. technology is integral to multiple stages of the semiconductor supply chain, including design, manufacturing, and testing.’

‘Although Huawei has built up an estimated two-year reserve of U.S. chips needed for its 5G base stations and cloud computing business, it lacks a similar stockpile of components that go into their smartphones, including memory chips, camera lenses, and 5G processor chips.’ - ‘Less than a month ago, it appeared that the company’s access to these items was unfettered, as it inked an agreement to continue licensing patented technology for its mobile phones from San Diego-based Qualcomm in late July.’

‘Now, the language of the Commerce Department’s announcement suggests that even this deal, which would have supplied Huawei with Qualcomm technology used by most mobile phones, will be negated.’ - ‘Analysts predict that if Huawei runs out of the components that go into their handsets, shipments could drop by as much as 75 percent next year.’

‘The Commerce Department’s actions follow a multi-year U.S. campaign to exclude Huawei from several markets that it hoped to supply 5G equipment to, including those of the Five Eyes, India, and several countries in the European Union.’ - ‘These are some of the largest markets outside of China and will result in massive revenue loss for the company.’

- ‘While Huawei remains an important telecommunications gear supplier in Southeast Asia, Latin America, and Africa, many countries in these regions will likely finally forgo partnering with the company for 5G, fearful that it will not be able to supply and maintain gear for their networks under the new restrictions.’

‘For years, the Chinese government has attempted to boost its domestic semiconductor industry, with mixed success.’ - ‘Despite tax incentives and multiple rounds of funding by the China National Integrated Circuit Industry Investment Fund since 2014, Chinese chipmakers are still unable to produce the chips that power high-end smartphones and 5G equipment.’

‘Estimates for how long it would take them to catch up to foreign counterparts range from three years to “generations.” ’ - ‘Huawei cannot afford to wait that long, and it is quickly running out of options.'

‘The Commerce Department’s actions are likely the death blow against Huawei.’ - Even its most secure markets will switch to new suppliers to prevent the inevitable disruption that will occur when its two-year stockpile of U.S.-made chips dries out.’

‘In the context of the U.S.-China tech war, the dashing of Huawei’s global aspirations is but one battle, and the United States should expect a punitive retaliation against its technology companies by the Chinese government.’ |

| 4. Flood Damage to the Chinese Economy |

BloombergAnjani Trivedi | Bloomberg'The last thing China’s burdened, state-run financial institutions need are continued natural disasters.’ ‘The Three Gorges Dam on the mighty Yangtze, the world’s largest dam is under pressure in the massive flooding that’s wiping away billions of dollars of value in China.’ - ‘The predicament symbolizes a looming crisis for Beijing.’

- ‘Climate change is bringing more frequent and intense deluges that threaten the economic heartland, and infrastructure defenses installed with the disasters of previous eras in mind can’t keep up.’

- ‘There’s very little time to prepare for what’s coming.’

‘The problem isn’t that China lacks water management projects.’ - ‘It has built hundreds of thousands of levees, dikes, reservoirs and dams on its seven major river systems.’

- ‘But many are struggling to cope with months of rain-fed flooding that has ravaged vast swathes of industrial and agricultural land and engulfed millions of homes.’

‘Flood policy hasn’t been made the a priority it should be given the high stakes.’ - ‘The Yangtze River Economic Belt is home to more than 40% of China’s population (about 600 million people) and accounts for almost 50% of export value and 45% of gross domestic product, according to China Water Risk.’

- ‘On its own, the region could be the third-largest economy in the world.’

‘More severe disasters are anticipated.’ - ‘Climate change is increasing the risks of extreme rainfall events, making it “even more likely that dams like the Three Gorges will be unable to prevent the worst flooding from occurring in the future,” hydroclimatologist Peter Gleick, a member of the U.S. National Academy of Sciences, told the South China Morning Post.’

‘Consider this knock-on effect.’ - ‘In theory, banks will likely take losses because of natural disasters; their clients will pass them along to insurers.’

‘In China, insurance companies aren’t well-prepared; statistics remain sparse and risk-modelling around flood events has become more difficult.’ - ‘In 2016, China’s non-life insurers were hit with losses of more than 4 billion yuan related to floods and storms between June and August.’

‘This time, Fitch Ratings Inc. analysts expect claims “to continue to surge as the rainy season is not over yet in certain parts of China.” ’ - ‘They noted on July 15 that insurers in Hubei, Guangxi and Jiangxi provinces had reported aggregate incurred losses of more than 500 million yuan as of a week earlier, including claims from motor, agricultural and property insurance.’

‘The last thing China’s burdened, state-run financial institutions need are continued natural disasters.’ |

| 5. Jerry Cohen on U.S.-China-Taiwan Relations |

| NewsweekJerry Cohen | Council of Foreign Relations‘Most important, the United States should abandon the policy of "strategic ambiguity" that fosters uncertainty about whether it will come to the defense of Taiwan.'‘None of the disputes between the U.S. and China, even the South China Sea, has as much explosive potential as contemplated changes in America's relations with Taiwan.’ - ‘Given the anti-PRC atmosphere in Washington, there is even interest in possible establishment of formal diplomatic relations between the United States and Taiwan.’

- ‘Such "recognition" of the island's government, whether under its current name—the Republic of China (Taiwan)—or as a newly-branded Republic of Taiwan, would very likely trigger a long-threatened military reaction from Beijing that could envelop the PRC, the United States and Taiwan in a devastating nuclear war.’

‘It would be much wiser to continue the policy of gradually demonstrating increased support for Taiwan's current status.’ - ‘Much more can be done by Washington and other concerned governments to build on existing "unofficial" arrangements for political, economic, educational and cultural cooperation with Taiwan, as well as for expanding its opportunities to contribute to many functional international activities.’

‘New forms of imaginative links with Taiwan must be developed.’ - ‘Of course, pressure for Taiwanese participation in existing public international organizations should be increased, as should efforts to help it retain its remaining formal diplomatic relationships.’

- ‘But this will require the U.S. to return to vigorous alliance diplomacy and to institutions and arrangements that it has recently abandoned, such as the World Health Organization and the Trans-Pacific Partnership.’

- ‘Otherwise, Beijing's growing role as gatekeeper will continue to frustrate global governance by excluding Taiwan, as WHO experience illustrates.’

‘Most important, the United States should abandon the policy of "strategic ambiguity" that fosters uncertainty about whether it will come to the defense of Taiwan, since this ambiguity increases the risk that conflict might result from mistaken assumptions on Beijing's part.’ - ‘The U.S. can anchor its relationship with Taiwan in long-standing policies, while articulating a clear but moderate statement of its determination to defend the island against unprovoked attack.’

‘This would serve as a strong reminder to the PRC that public international law no longer permits nations to use force to settle territorial disputes.’ - ‘Such an assurance will do much more to protect the 23 million Taiwanese than would formal U.S. diplomatic recognition.’

|

NewsweekJerome Cohen | Council on Foreign Relations‘Beijing has long maintained that any formal declaration of independence by Taiwan would be intolerable and trigger possible nuclear war.’More from Jerry Cohen's terrific essay.‘To understand why Taiwan is a flashpoint requires recalling recent history.’ ‘When in 1949, Chiang Kai-shek's Nationalist forces lost the Chinese Civil War on the mainland to Mao Zedong's Communists, Chiang's central government, called the Republic of China (ROC), fled to Taiwan.’ - ‘The ROC had reincorporated Taiwan into China four years earlier, after the Allied Powers, victorious in World War II, authorized Chiang's military to occupy the island, which had been a Japanese colony for half a century.’

‘China had been forced to transfer sovereignty over Taiwan to Japan in the 1895 peace treaty that ended the First Sino-Japanese War.’ - ‘Following Japan's 1945 defeat in World War II, Tokyo surrendered sovereignty over the island but, because of the ongoing Chinese Civil War, the post-World War II treaty arrangements never specified whether that sovereignty was transferred to the ROC, then occupying the island, or to the PRC, which established its national government on October 1, 1949, or to some other status.’

‘Taiwan's legal status was thus in doubt as Mao's PRC forces were preparing an assault that might overcome Chiang's control of the island and terminate the civil war.’ - ‘The highly debated question in Washington was whether the United States, which had long equivocated about how to respond to China's civil war, would intervene in the Taiwan Strait to defend the ROC.’

‘In January 1950, President Harry S. Truman and Secretary of State Dean Acheson announced, amid great controversy, that the U.S. would not intervene.’ - ‘Despite the fact that no peace treaty had transferred Taiwan's sovereignty to either of the still-contending Chinese governments, Washington maintained that Taiwan had, in fact, been restored to China when Chiang's forces were placed in control of the island.’

- ‘That, stated Secretary Acheson, was done in accord with the allies' wartime commitments, and "nobody raised any lawyer's doubts" about it.’

- ‘The U.S. thus concluded that, since Taiwan should be deemed Chinese territory, Washington should not intervene, since intervention would subject it to international condemnation for violating China's territorial integrity.’

‘Yet less than six months later, when North Korea invaded South Korea, the U.S. immediately reversed its position.’ - ‘Because it perceived the North Korean attack to be not only the initiation of civil war in Korea, but also an all-out attack by the communist bloc that threatened Taiwan as well as French-controlled Indochina, President Truman announced that the legal status of Taiwan, referred to by its Anglo-Portuguese name "Formosa," had actually never been determined and that it would await "restoration of security in the Pacific, a peace settlement with Japan or consideration by the United Nations"; in the interim, America's Seventh Fleet would defend Taiwan.’

‘That stunning reversal remained the official U.S. position for over 20 years.’ - ‘It was the principal obstacle to establishment of diplomatic relations between the U.S. and the PRC, even after the ROC was replaced by the PRC as the Chinese representative at the UN.’

‘Chairman Mao insisted that if the U.S. wanted to normalize bilateral relations, the U.S. would not only have to give up its diplomatic relationship with the ROC, but also formally concede that Taiwan is Chinese territory—a position that Chiang Kai-shek himself shared.’ - ‘That was the challenge confronting President Nixon when he made his world-famous visit to China in February 1972.’

‘There, in the Shanghai Communique, he waded into the problematic waters of whether Taiwan is part of China.’ - ‘The U.S. not only "acknowledged" the PRC claim that all Chinese on either side of the Strait believe that Taiwan is part of China, but also went on to state that "the United States does not challenge that position." ’

‘Nevertheless, when negotiating normalization with Beijing in 1978, President Jimmy Carter, while agreeing to terminate the U.S.-ROC defense treaty as well as diplomatic relations with the ROC, secured Deng Xiaoping's temporary willingness to tolerate continuing American arms sales to Taiwan.’ - ‘Congressional adoption of the Taiwan Relations Act (TRA), several months after normalization, further documented abiding American concerns for Taiwan's defense against possible PRC resort to force.’

‘The TRA even presented an ambiguous possibility that the U.S. might itself come to Taiwan's defense, if necessary.’ - ‘The premise of the U.S. position, expressed in the 1979 normalization joint communique and two subsequent ones with the PRC, is that the U.S. will accept a peaceful resolution of the Taiwan Strait dispute that is freely consented to by both sides.’

‘In 1979, both sides of the Strait were governed by harsh military dictatorships.' - ‘The American hope was that, over time, each government might evolve in democratic fashion and eventually find a cross-Strait modus vivendi.’

‘Since 1987, Taiwan has gradually and peacefully achieved the democratic, rule of law, human rights-protecting society for which it is now widely praised.’ - ‘The PRC, by contrast, has developed into an extraordinary economic powerhouse with a military that increasingly threatens Taiwan and a political system that, under Xi Jinping, has become the most successfully repressive regime in Chinese history.’

‘Nevertheless, despite the growth of a distinctive Taiwanese identity that has led most islanders to fear reunification with the mainland, the ROC, under the Nationalist government of President Ma Ying-jeou, from 2008 to 2016 made over 20 "semi-official" agreements with the PRC that opened up broad cross-Strait cooperation.’ - ‘That remarkable feat was based on the shared belief of the Nationalist government and the PRC that Taiwan is part of China, although many Taiwanese doubted the wisdom of this development and there was never any agreement on whether this notional "China" should be represented by the ROC or the PRC.’

‘In 2016, this limited and abstract "one China consensus," usually referred to as "the 1992 consensus," dissolved with the island's election of President Tsai Ing-wen of the Democratic Progressive Party, which had never accepted "the 1992 consensus." ’ - ‘President Tsai, a moderate leader of a party long associated with the goal of establishing independent Taiwanese statehood, nevertheless made clear from the outset her desire to continue Taiwan's cooperation with the PRC, convinced, as she put it after her resounding 2020 re-election, that "both sides have a duty to find a way to exist over the long term." ’

- ‘Yet she has steadfastly refused to endorse "the 1992 consensus," because to do so would deprive Taiwan of the future option to deny that the island is Chinese territory, to declare its formal independence from China and to establish diplomatic relations with other countries on that basis.’

‘Beijing has long maintained that any formal declaration of independence by Taiwan would be intolerable and trigger possible nuclear war.’ - ‘President Tsai, a careful leader who has shown no interest in exercising what may justifiably be called the nuclear option, has countered by claiming that no formal declaration is necessary since Taiwan has long enjoyed de facto independence.'

- 'Xi Jinping's reaction has been to cease many aspects of the cross-Strait cooperation and contact attained under President Ma, and to mobilize ever-greater military, political, diplomatic, economic and psychological pressures on the Tsai government in the hope of coercing it to belatedly embrace the "one China consensus." ’

‘The Trump administration, reflecting its inconsistent efforts to forge an overall policy toward the PRC, for most of its almost four years paid relatively little attention to Taiwan.’ - ‘Although continuing to sell arms to the island, the administration sought to avoid offending Beijing in most of its ostensibly "unofficial" contacts with the island.'

- 'But that policy has now changed as part of its recent all-out efforts to challenge the PRC, and Washington has made many new moves to demonstrate stronger support for the island’.

‘It is in this context that the possibility of U.S. establishment of formal diplomatic relations with Taiwan must be discussed.' - 'Such a dramatic move, which might be thought to sustain President Trump's flagging re-election prospects, would be a leap too far and very likely lead to tragedy for all concerned.’

|

|

)